are closed end funds riskier

A not-for-profit association CEFA is committed to educating investors about the many benefits of these unique investment products and to providing a resource for information about its members and their offerings. Speak with an Investment Fraud Attorney.

Do Closed End Funds Perform Better Than Open Ended Funds Quora

10 Best Closed-End Funds.

. Plus closed-end funds that return capital can carry a higher level of risk because the asset base needed to generate income to pay future distributions is. Changes in interest rate levels can directly impact income generated by a CEF. Just like open-ended funds closed-end funds are subject to market movements and volatility.

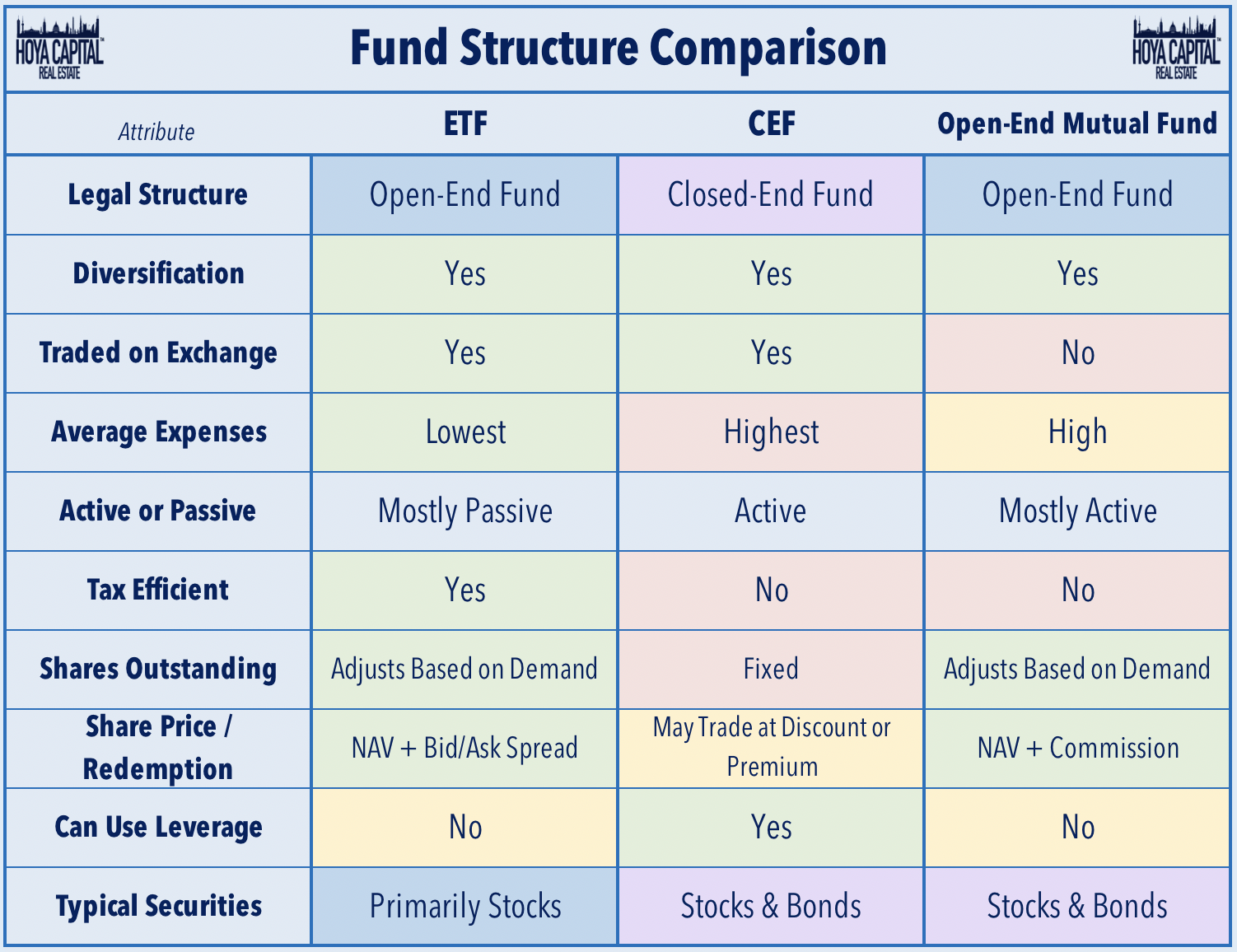

Closed-end funds are structured differently than their open-end cousins with potentially more capital stability that can benefit more risk-inclined fund managers. Closed-end assets are riskier than open-end assets which is fine for those with a long time horizon. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital.

The primary difference is that closed-end funds are not redeemable with the issuer and the price may vary from the value of the underlying investments. This allows them to invest in riskier assets which typically pay relatively high yields and to use leverage which can boost the portfolios income. And the structure of closed-end funds provides managers with the kind of stable capital they need to take on riskier investments such as directly putting money into buildings and projects.

Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns. Finally closed-end funds have higher expense ratios than open end mutual funds and ETFs because CEFs typically have smaller asset balances. In addition closed-end funds are more volatile than open-end mutual funds and ETFs due to the leverage but also because CEFs can sell at a premium or discount to the net asset value.

A closed-end fund is a type of investment company that shares many similarities with mutual funds and ETFs. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Because CEFs have closed-end structures their capital is relatively stable.

Despite the addition risk of employing leverage closed end funds have an admirable track record of producing positive absolute returns relative to unleveraged funds of comparable holdings. The Closed-End Fund Association CEFA is the national trade association representing the closed-end fund industry. A closed-end fund is not a traditional mutual fund that is closed to new investors.

Many income-seeking investors are drawn to closed-end funds CEFs because of their relatively high distribution rates. A closed-end fund or CEF is an investment company that is managed by an investment firm. However leverage increases the funds price volatility as well creating more risk for the investor.

They reportedly heavily marketed these closed-end funds as being a relatively safe fixed-income investment where the client would likely not. If the fund took on 20 of debt to buy more bonds it would receive more income using the same amount of net assets. The cost depends on the fund itself.

People should be aware that when the market pulls back or has a major move these funds move more. Both have an underlying portfolio of investments with a net asset value. 2 days agoClosed-end funds are generally volatile Finley said.

CEFs share some traits with traditional open-end mutual funds. The value of a CEF can decrease due to movements in the overall financial markets. Closed-end funds raise a certain amount of money through an initial public offering or IPO after which.

Kurta Law is a national investment fraud law firm that exclusively represents defrauded investors. To discuss your closed-end fund fraud case with an attorney in confidence call 877-600-0098 or request a free consultation online today. Three PIMCO closed-end funds recently cut their dividends causing some analysts to state that the resulting selloff is a buying opportunity.

The longer you plan on staying invested the longer you have to make up for declines should something go wrong. Closed-end funds are professionally managed and trade throughout the day on an exchange. And even though CEF shares trade on an exchange they are not exchange-traded funds ETFs.

For example suppose a closed-end fund had 100 of net assets and invested everything into bonds.

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Guide To Closed End Funds Money For The Rest Of Us

Difference Between Open Ended Funds Vs Close Ended Funds

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Difference Between Closed End Fund And Exchange Traded Fund Differbetween